Your platform for digital assets CFD margin trading

Trade with confidence on the regulated platform for the EU Residents

Institutional grade standards for protecting your funds and data

Best execution price guarantee

Oversight and accountability to the EU regulator, CySEC

Fees

Get the best out of CFD trading

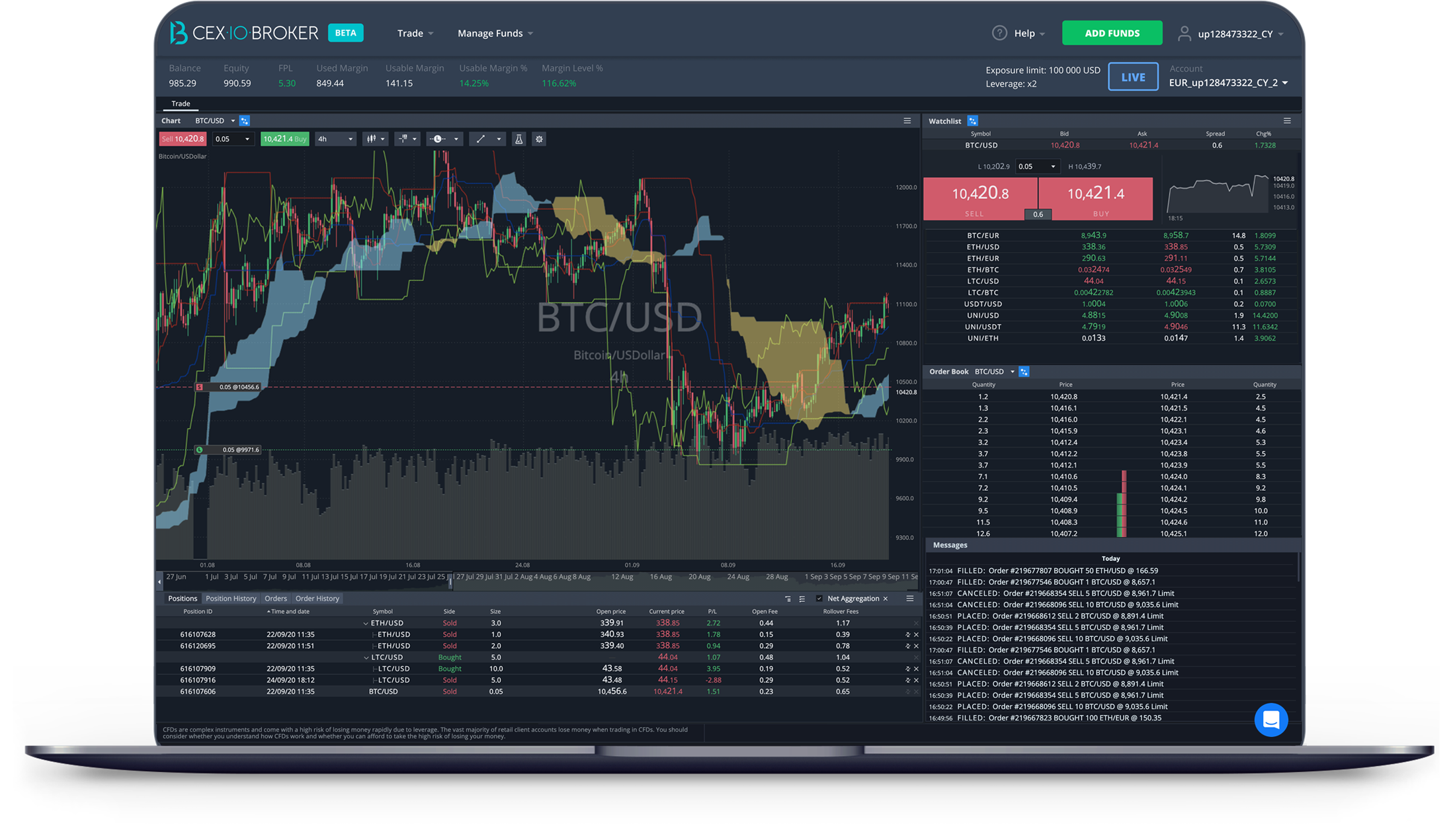

Multi-account trading terminal

Multiple segregated positions

Advanced risk management

Technical analysis instruments

Professional Orders

Trade digital assets CFDs with leverage in just a few minutes!

Fair, transparent, and efficient margin trading with an easy-to-use interface and professional tools

Who is CEX.IO Broker for?

Trade with low cost

Tight spreads

Start gaining from the smallest movements in price with narrow bid-ask spreads on each currency pair

Low fees

Stay on top of your costs and benefit from the most competitive and transparent fees in the market

Ultrafast performance

Remain in the driver’s seat as you quickly place and modify your trades in the dynamic market conditions

High liquidity

Execute orders of any size with minimal slippage due to the aggregated liquidity provided by top exchanges

Practice trading with Demo Account

Master margin trading with the instant DEMO account and paper money! No registration needed!

Get your hands on all the tools and test the platform in the simulated environment that reflects the market conditions.

One click, and you are ready!

Market tenure

Since 2013, CEX.IO has been serving global clients in over 200 countries and territories. We built CEX.IO Broker based on the years of digital assets markets knowledge and experience.

Legal compliance

CEX.IO Group maintains license in multiple jurisdictions. We hold ourselves accountable to the high standards mandated by the regulatory requirements.

Multiple payment options

CEX.IO supports Visa, Mastercard, bank transfers, and digital assets transactions. Execute and fund your trading strategies on spot and derivatives markets under one umbrella.

Advanced API

CEX.IO offers the full support of FIX API, WebSocket, and HTTP REST API. You can take your automated trading to the next level based on your needs and your goals.